Exchange Rate Pass-Through into Swiss Prices1

DOI Nr.: https://doi.org/10.25929/njxp-6z46

Kersten Kellermann

Technische Hochschule Deggendorf

Carsten-Henning Schlag

Konjunkturforschungsstelle Vierländereck (KOVL)

ABSTRACT

The effective exchange rate of the Swiss franc has soared since 2007. Yet the appreciation has led only to a minor adjustment of Swiss import prices, consumer prices for imported goods and overall consumer prices. We apply an approach proposed by Campa and Goldberg (2005) to show that exchange rate pass-through (ERPT) is generally low, but slightly higher with respect to import prices than with respect to consumer prices. It increases when the adjustment period is extended. Our estimation results show that the exchange rate changes are largely absorbed in cross-border trade. In the time period of 1980-2007 Swiss consumers of imported goods felt only around 27% of the initial exchange rate shocks.

JEL Classification: E31; F31; F41; C22

Der Außenwert des Schweizer Frankens ist seit 2007 stark angestiegen. Die Aufwertung hat jedoch nur zu einer relativ geringen Anpassung der Schweizer Importpreise, Konsumentenpreise für importierte Güter sowie des Konsumgüterpreisindexes geführt. Im Beitrag wird – basierend auf einem Ansatz von Campa und Goldberg (2005) – gezeigt, dass die Wechselkurselastizität Schweizer Preise generell gering ist. Die Übertragungseffekte (exchange rate pass-through, ERPT) im grenzüberschreitenden Handel sind dabei etwas höher als die Übertragungseffekte in Bezug auf die Konsumentenpreise. Die Reagibilität erhöht sich, wenn die Anpassungsphase verlängert wird. Unsere Schätzergebnisse legen den Schluss nahe, dass ein Großteil der Wechselkursschwankungen im grenzüberschreitenden Handel absorbiert wird. Im Untersuchungszeitraum 1980 bis 2007 reflektieren sich nur 27 Prozent der Wechselkursschocks auf die Schweizer Konsumentenpreise importierter Güter.

KEYWORDS

Import prices, consumer prices, nominal effective exchange rate of the Swiss franc, exchange rate pass-through, terms of trade, Switzerland

Importpreise, Konsumentenpreise, nominaler effektiver Wechselkurs des Schweizer Franken, Überwälzung von Wechselkursveränderungen, Terms of trade, Schweiz

1. A Strong Swiss Franc: Pain with no Gain?

The effective exchange rate of the Swiss franc (CHF) reached a historic peak in the summer of 2011. In mid-August 2011 one Euro cost CHF 1.01 compared to CHF 1.62 in August 2011. In September 2011, the Swiss National Bank (SNB) felt impelled to set a minimum threshold at an exchange rate of CHF 1.20 per Euro, in order to mitigate the negative effects of a stronger Swiss franc. This move arose primarily because of the loss of competitiveness of Swiss products on European markets.2 It partially corrected the massive overvaluation of the Swiss franc. Nevertheless, on January 15th 2015, the Governing Board of the SNB decided that the minimum exchange rate was no longer sustainable and would thus be discontinued. A step that again led to considerable market appreciation of the Swiss franc (Jordan, 2015, p. 2).

However, a strong currency not only is a burden for an economy but also provides an upside – a so-called dividend to the country. One particularly would expect consumers to benefit from potentially declining import prices.3 But with respect to the appreciation of the Swiss franc this does not appear to be the case. According to the Swiss consumer protection society (SKS – Stiftung für Konsumentenschutz), the prices for imported goods have barely dropped since 2011, as underscored by numerous examples from the retail sector (SKS, 2011). Swissmem – the Association of the Swiss Mechanical and Electrical Engineering Industries – also announced that prices of intermediate products didn’t adjust as expected and that currency gains were barely passed through to domestic producers (Hess, 2011). It is still unclear as to where the benefits of the strong Swiss currency are absorbed along the sales chain between foreign producers and domestic consumers. Domestic retailers claim that the problem lies with foreign producers who have been driving up import prices in foreign currencies. A view which to a certain degree is backed by our findings.

Our results show that domestic prices on the import and the consumer level only sluggishly respond to the appreciation of the Swiss franc.4 The responsiveness of domestic prices arising from exchange rate changes is referred to as exchange rate pass-through (ERPT) (Goldberg and Knetter, 1997). Over the past years, numerous empirical studies on ERPT have been published, among them microanalyses that review the ERPT between firms and locations in various currency zones, and studies that evaluate aggregated data, mostly on a national economy scale (Engel, 1999, McCarthy, 1999, Campa and Goldberg, 2005, Campa et al., 2005).5

The paper on hand follows these studies, but first highlights the description of basic statistical data. It is structured as follows: Section 2 distinguishes three levels of ERPT, and Section 3 lists some key empirical findings of the ERPT literature related to Switzerland. Section 4 illustrates the rise of the Swiss franc’s effective exchange rate since 1974 and shows that in spite of vigorous appreciation, after the second quarter of 2009, the rising Swiss franc was first accompanied by a decline in terms of trade. The ERPT with respect to import prices in cross-border trade and on the consumer level are considered in Section 5. Section 6 provides a description of the exchange rate responsiveness of overall consumer prices. Section 7 discusses the question of where the exchange rate gains are absorbed in the distribution process between foreign producers and Swiss consumers. The shares of exchange rate shock absorption that occur along the sales chain are explicitly quantified. Section 8 summarizes the key findings.

1 The authors would like to thank an anonymous referee for valuable comments.

2 In May 2012 Jean-Pierre Danthine, the Vice Chairman of the Governing Board of the Swiss National Bank writes, that „[…] the

massively overvalued Swiss franc first threatened demand for Swiss exports.“ (Danthine, 2012).

3 See for example a statement by Starbatty (2011).

4 The Swiss Executive Federal Council reacted to this situation by revising the Swiss anti-trust law (EVD, 2011a). The Council

justified this competition policy measure explicitly in light of the strong Swiss franc and an inadequate pass-through of exchange rate benefits (EVD, 2011b).The Swiss Competition Commission, which for a long time had been examining potential violations of the antitrust law, welcomed this step (WEKO, 2011). Yet, the Swiss Association of Importers (VSIG, 2011) stated that consumers had already put enough pressure to get sluggish prices moving.

5 In addition, econometric approaches have been applied, based on multivariate models, cointegration methods, and models that

allow mapping of asymmetric and nonlinear relations between currency and pricing variables (Sekine, 2006, Stulz, 2007, De Brandt et al., 2008, Chew et al., 2011, Tressel, 2011).

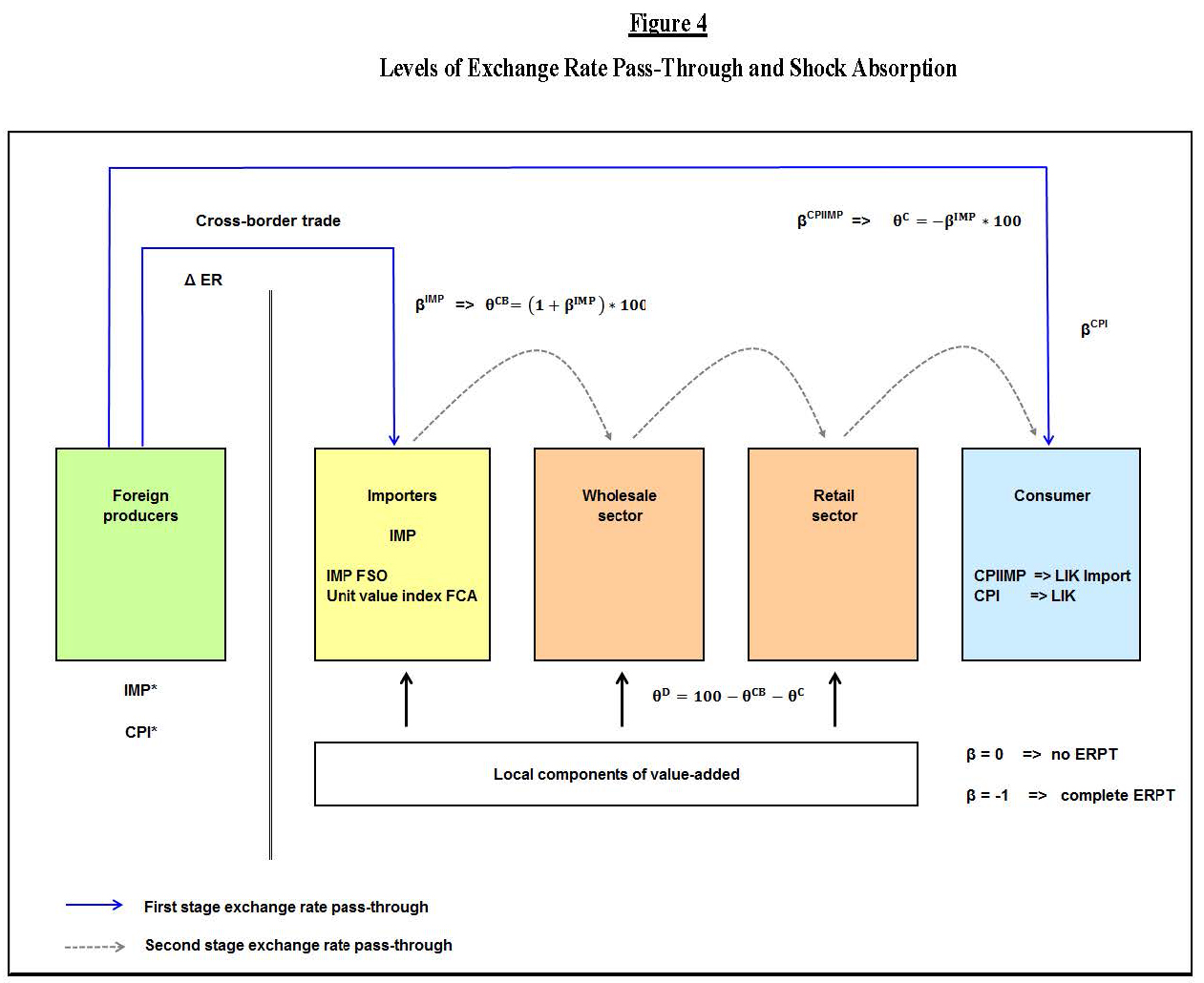

2. Three Levels of Exchange Rate Pass-Through

Exchange rate pass-through (ERPT) to domestic prices can be viewed from two sides – the import and the export side. In the following, we focus primarily on the import side, where exchange rate changes can potentially impact import prices (IMP), prices of imported consumer goods (CPIIMP) and the overall consumer price index (CPI).6 Formally, ERPT is measured as the percentage change of domestic prices in local currency resulting from a one percent change in the exchange rate.

IMP-ERPT measures the responsiveness of import prices and, therefore, describes a pass-through phenomenon that occurs in cross-border trade of goods and services. A low IMP-ERPT means that exchange rate changes have little impact on import prices. In the literature, IMP-ERPT is often discussed with respect to issues in competition policy (Taylor, 2000, Stulz, 2007, Campa and Goldberg, 2005). Since summer 2011, Swiss retailers have stated repeatedly that foreign importers of branded goods exploited their market power by absorbing exchange rate gains.7 This would require that importers have maneuvering room to discriminate prices internationally – a policy that is referred to as pricing-to-market (Dornbusch, 1987).8

CPIIMP-ERPT describes the exchange rate pass-through into prices of imported consumer goods traded on the retail level. There are several reasons why CPIIMP-ERPT could be incomplete. One is that imported and domestically produced consumer goods and services cannot be clearly differentiated. Most imported goods are traded, transported, warehoused, financed, and insured within the country. These local components of value added impact the prices of imported goods in the local currency, however, these components are not directly affected by changes in nominal exchange rates. They are higher on the consumer goods level than on the cross-border trade level so that the exchange rate responsiveness shrinks (Burstein et al., 2003). In addition, domestic retailers possibly absorb temporary exchange rate changes in order to minimize their menu costs (Figure 4). This applies in particular with respect to short-run fluctuations. Froot and Klemperer (1989) use U.S. data to demonstrate that permanent nominal exchange rate shocks have a greater impact on local currency prices than temporary shocks. Hedging exchange rate risks, for example, through capital market instruments, can also lower the responsiveness of local currency prices.

CPI-ERPT quantifies the pass-through of nominal exchange rate changes to overall consumer prices, measured as CPI. This ERPT is often discussed in the context of monetary policy issues where a low CPI-ERPT is sometimes referred to as indicating successful monetary policies (Taylor, 2000, Stulz, 2007, Campa and Goldberg, 2005, Gagnon and Ihrig, 2004). Adolfson (2001) stresses that – in reverse causality – the effectiveness of monetary policy is also conditioned upon the degree of CPI-ERPT.9

6 See Appendix 1.

7 Auer and Schönle (2012) examine the extent to which market structure can explain incomplete exchange rate pass-through.

They evaluate how pass-through rates vary depending on the mass of firms affected by a particular exchange rate shock and the distribution of firms‘ market shares.

8 If foreign producers set their prices in the importing nation’s currency, their profit or markup floats freely with the exchange

rate. The markup rises if the currency of the destination country appreciates. This is in line with the local currency pricing (LCP) model, where nominal exchange rate changes do not evoke price adjustments in the importing country. In other words, no ERPT occurs, at least not over the short run (Engel, 2003). However, according to the producer currency pricing (PCP) model, foreign producers set prices in their own currency, which results in a complete ERPT (Obstfeld, 2002, Obstfeld and Rogoff, 2000b). The question in which currency foreign producers set their prices is crucial in this context (Corsetti, 2007). Fischer et al. (2010) show that in Switzerland big exporters in particular follow pricing to market strategies.

9 The measurement and interpretation of CPI-ERPT is thus especially complex so that the application of system methods may

be more appropriate than single-equation models. Sekine (2006) and Chew et al. (2011) differentiate between a first-stage pass-through and a second-stage pass-through. Under the first stage, they refer to the pass-through of import prices resulting from changes in the nominal exchange rate; the second stage reflects the influence of import prices on the domestic CPI. Amstad and Fischer (2010) analyzed the pass-through of import prices on the Swiss national consumer price index from 1993 to 2008 and determined a coefficient of 0.3.

3. Key Empirical Findings of ERPT

ERPT can be measured as short-run, medium-run and long-run coefficients for various trade levels and different categories of goods. In Switzerland-related ERPT literature the following empirical findings and stylized facts are reported: Import prices tend to be more sensitive to changes in the nominal exchange rate than consumer prices. Tressel (2011) looks at the sample period of 1980 to 2010. His long-run IMP-ERPT coefficients for Switzerland range from –0.3 to –0.6, whereas the corresponding CPI-ERPT coefficients lie between –0.02 and –0.05. Stulz (2007) examines the sample period of 1976 to 2004 and applies a vector autoregressive model to show that after an adjustment period of one year the cumulative IMP-ERPT coefficient is –0.5, while the CPI-ERPT coefficient equals –0.17. The State Secretariat for Economic Affairs (SECO, 2011) by applying the approach of Stulz to the sample period of 1995 to 2011 – derives a pass-through coefficient of –0.4 with respect to import prices.10 With monthly data that cover the years between 1999 and 2010, Herger (2012) estimates an exchange rate pass-through elasticity onto aggregate import prices of –0.3. McCarthy (1999) and Gagnon and Ihrig (2004) found the CPI-ERPT coefficients for Swiss data to be either minimal or statistically insignificant, whereas the IMP-ERPT coefficients prove slightly higher.

ERPT for import prices differs significantly by category of imported goods and services. A study done by the Deutsche Bundesbank (2008) comes to the result that depending on the category of goods, a one percent change in the nominal exchange rate impacts import prices in local currency by –0.1% up to –0.8%. In particular, imports of raw materials like crude oil and coffee or categories of goods with high shares of raw materials proved more sensitive to exchange rate changes than others. SECO (2011) examines the ERPT for 18 import categories for Switzerland. As expected, the pass-through effects were found to vary with exchange rate changes being relatively well reflected in prices for raw materials (Balastèr, 2011, SECO, 2011).

In the long run, ERPT is generally higher than in the short run. Campa and Goldberg (2005) estimate a short-run IMP-ERPT coefficient of –0.68 and an elasticity of –0.93 after an adjustment period of one year for Switzerland. Adolfson (2001), Heath et al. (2004), de Brandt et al. (2008), and Chew et al. (2011) apply cointegration methods to identify short and long-run effects in various countries. They observe complete IMP-ERPT over the long run. Other analyses focus on the issue of whether the degree of ERPT has changed over time. Taylor (2000), Goldfajn and Werlang (2000) show declining ERPT coefficients. Stulz (2007) concludes that in Switzerland, ERPT dropped during the 1990s where the observed decline was greater for consumer prices than for import prices. For six industrial countries in the sample period of 1974 to 2004, Sekine (2006) also shows a decline in ERPT at both trade levels. He attributes this development to an increasingly effective monetary policy. However, Campa et al. (2005) illustrate that the launching of the common currency in the Euro zone did not cause any structural changes with respect to ERPT.

10 SECO (2011) does not explicitly consider CPIIMP.

4. Terms of Trade

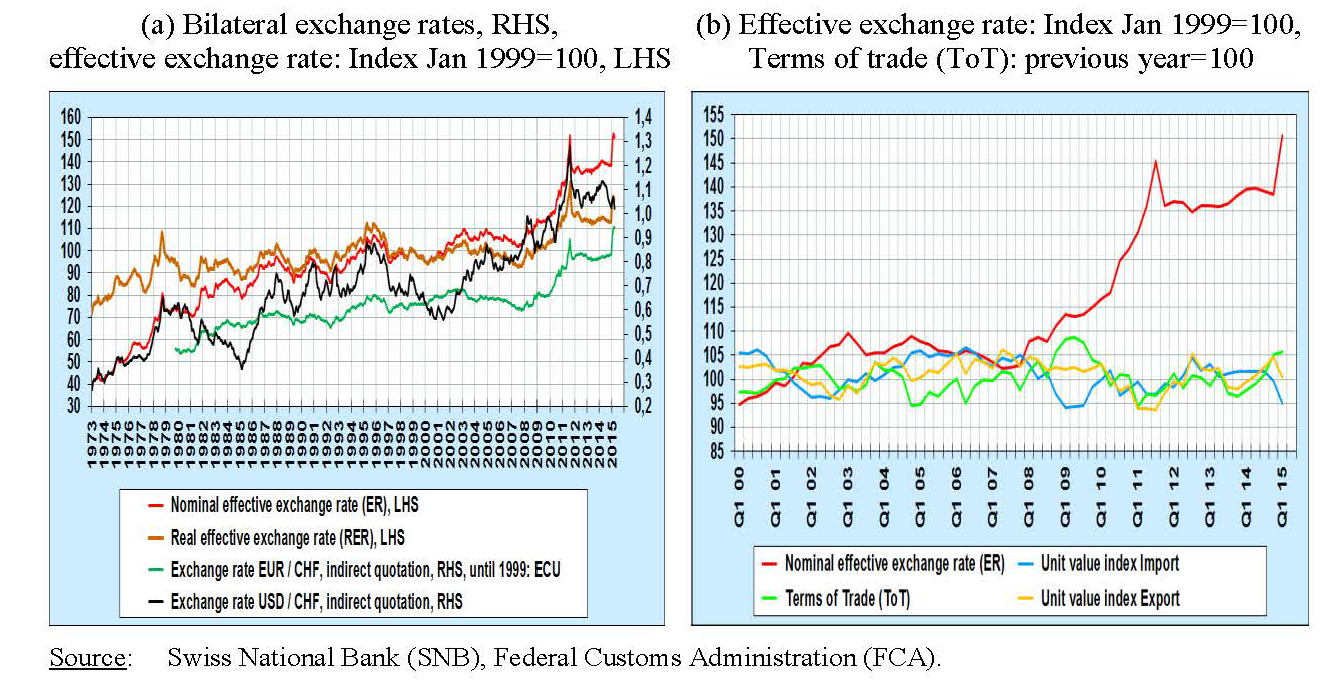

Since the Bretton Woods system was abandoned in 1973, both the effective exchange rate and key bilateral exchange rates of the Swiss franc have followed a slightly increasing trend (Figure 1, Part a).11 This trend soared once the financial crisis erupted in the fall of 2007, marked by a rise of the nominal effective exchange rate of more than 49% (October 2007 to August 2011).12 According to Hildebrand (2011), this appreciation has resulted in a massive overvaluation of the Swiss franc and thus carried the risk of a recession as well as deflationary developments for the Swiss economy.

Figure 1: Bilateral exchange rates, effective exchange rates of the Swiss franc, terms of trade (goods), export and import prices

However, since all local consumers of imported goods benefit from potentially declining import prices, the appreciation of the Swiss franc should also show an upside – a so-called dividend to the country. Explicitly, one would expect that the surge of the effective exchange rate increased the amount of import goods the Swiss economy would be able to purchase per unit of export goods. The reason is that a rise in the value of the Swiss franc lowers the domestic prices of imports more than the local currency prices of exports. As a consequence of the appreciation, Swiss terms of trade are supposed to improve. Obstfeld and Rogoff (2000b) attribute this reaction of the terms of trade in the appreciating country to rising relative wages. Yet, under a regime of so-called local currency pricing where responses of import prices to exchange rates changes are assumed to be nil, currency appreciation shows an opposite effect by worsening the country’s terms of trade. Finally, in a neoclassical world where all prices adjust flexibly and, thus, the law of one price holds nominal exchange rate changes do not have an effect on the terms of trade.

Figure 1 (Part b) illustrates that the Swiss terms of trade (ToT) did not actually react sharply to the rapid increase of the effective exchange rate. ToT are measured as the relative export prices index (EXPt) and import prices index (IMPt)

at time t

where EXPt* denotes export prices in foreign currency and ERt denotes the nominal effective exchange rate of the Swiss franc (Appendix 1). After the second quarter of 2009, the rising ERt is first accompanied by a decline in ToTt that later turns into a stagnation and eventually turns into a slight increase in 2014. The relative stability of Swiss ToTt could be taken as an indication for the validity of the law of one price (LOP). In this case, the pass-through to import and export prices is expected to be rapid due to an instantaneous adjustment of a small open economy to world prices. But again, a simultaneous decline of EXPt and IMPt is not shown in the data (Figure 1, Part b). The stickiness of ToTt is caused rather by a low responsiveness of the two price indexes, EXPt and IMPt.13

11 See Appendix 1.

12 This vigorous appreciation was also reflected in the price of the U.S. Dollar and the Euro. The Euro zone countries are by far the

major trading partners for Switzerland. The nominal effective exchange rate increased by 36% from October 2007 to December 2014.

13 See Appendix 1.

5. Exchange Rate Pass-Through for Imported Goods and Services

As mentioned above, our focus lies on the import side. In order to learn more about the responsiveness of the prices of imported goods and services, we look at the relative development of the relevant macroeconomic time series. The data show an unusual response pattern of Swiss import prices after the nominal effective exchange rate shock occurred in the second half of 2007. In our estimation approach, we take this observation into account and examine the question whether the magnitude of pass-through elasticity has changed after 2007. Thus, appropriate procedures for testing parameter stability of the ERPT coefficients are applied.

5.1. A first look at Swiss data: Have things recently changed?

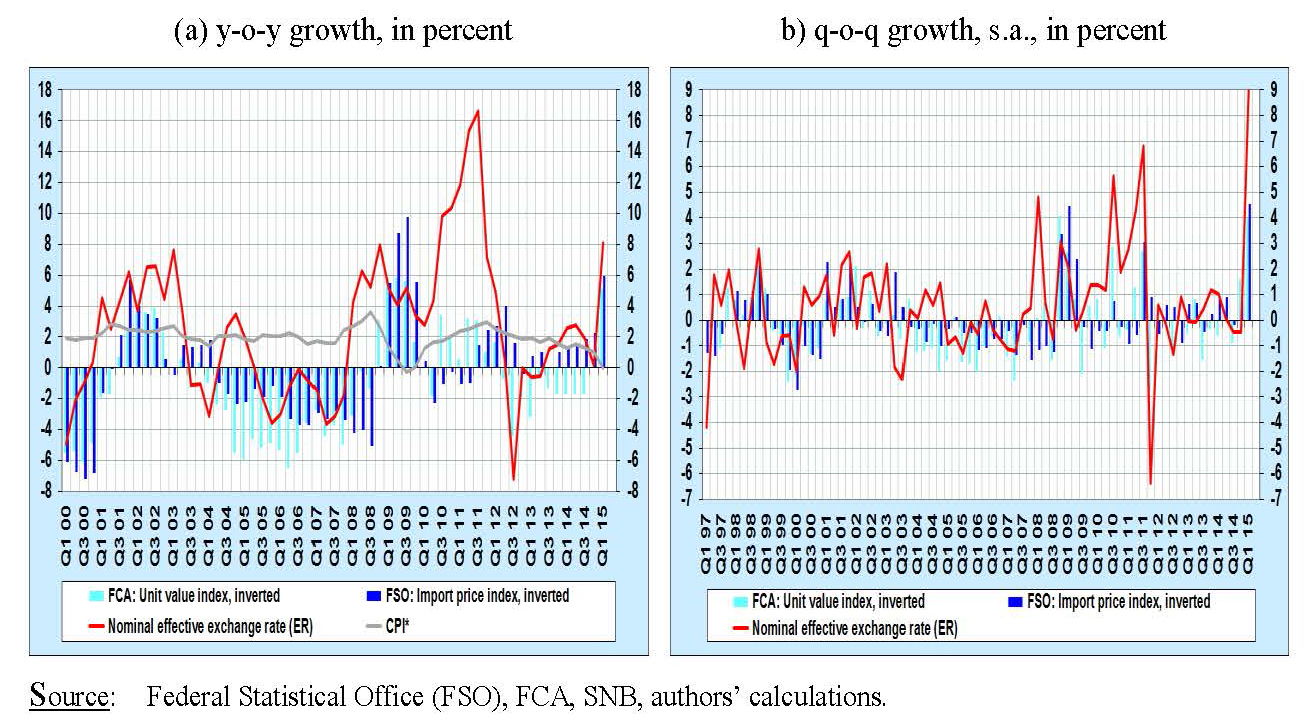

Figure 2 (Part a) illustrates the annual rise of the import price index ∆lnIMPt versus ∆lnERt. The red line shows ∆lnERt, which lies above the zero line during appreciation phases and below it during depreciation phases. IMPt is operationalized in two ways: First, as the import price index of the Federal Statistical Office (FSO) shown as dark columns and secondly, as the unit value index of the Federal Customs Administration (FCA), shown as the lighter column (Appendix 1). Both columns are inverted, which means that a drop in nominal prices points upwards. Figure 2 depicts a certain degree of synchronicity in exchange rate and import price changes. Yet, it is quite evident that the co-movement between ∆lnERt and ∆lnIMPt has changed in recent years.

- The depreciation of the Swiss franc in the year 2000 and from 2003 to 2007 was on a comparable order of magnitude as the rise in import prices.

- The Swiss franc appreciated from 2001 to 2003. The annual increase of the nominal effective exchange rate was between 4% and 8%. For eight quarters, a drop of import prices of up to 6% accompanied this development. A second appreciation phase started at the end of 2007, and after a certain time lag the import prices also decreased. In 2009, prices fell by up to 10%, which exceeds the rise in the effective exchange rate – primarily as a result of a major economic downturn (Figure 2, Part a).

- The upward pressure on the Swiss franc rose significantly in 2010 and 2011, leading to year-over-year (y-o-y) rises of the ERt of up to 16%. At the same time, import prices (based on the import price index of the FSO) increased slightly by 1% y-o-y. The unit value index of the FCA behaved as expected and declined; however, the price reduction remained below 4% (Figure 2, Part a).

- With respect to short-run dynamics, measured as quarter-over-quarter (q-o-q) increase (based on seasonally adjusted data), the counterintuitive movements of import prices are even more evident (Figure 2, Part b). After 2007Q3 ERt rose – except in 2008Q3 and 2009Q2 – steadily for 14 quarters. Over the same period, the import price index fell for five quarters and rose for 11 quarters.

Figure 2: Import prices, nominal effective exchange rate and foreign consumer price index

5.2. Short- and medium-run IMP-ERPT and CPIIMP-ERPT

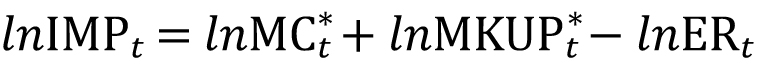

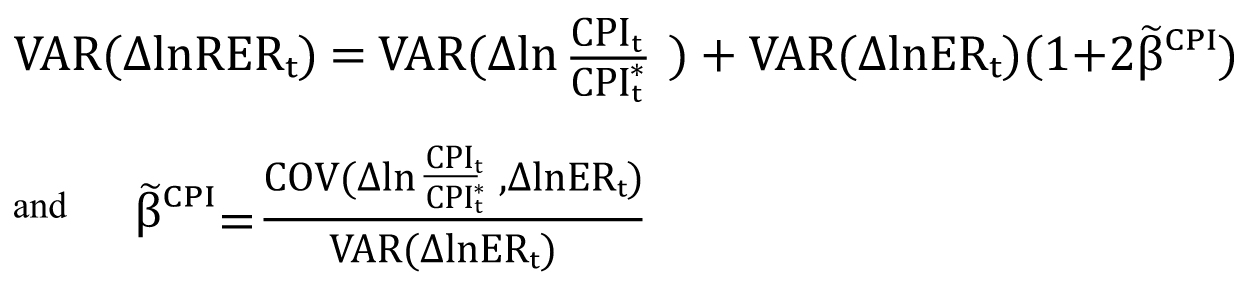

According to Campa and Goldberg (2005), the logarithm of the price index of imported goods in foreign currency lnIMPt* can be expressed as the sum of the logarithm of manufacturing costs lnMCt* faced by foreign producers and the markup lnMKUPt* that represents a profit margin. Since lnIMPt=lnIMPt*-lnERt holds, the import price index can thus be expressed as

Campa and Goldberg (2005) state that the markup lnMKUPt* has a component that is potentially sensitive to changes of the exchange rate. The manufacturing costs lnMCt* depend on prices in the trading partner’s markets CPIt*. From these considerations Chew et al. (2011) conclude that the price index of imported goods in the local currency

is a function of the price index of the home country’s trading partner’s CPIt* and ERt, whereby the coefficient γ reflects the elasticity of import prices with respect to foreign manufacturing costs.14 The coefficient βIMP=-ε measures the IMP-ERPT, the elasticity of the prices of imported goods with respect to exchange rate variations (Chew et al., 2011). It takes on a value of –1 if the IMP-ERPT is complete.15 Campa and Goldberg (2005) and Campa et al. (2005) propose a model to estimate short-run and medium-run IMP-ERPT coefficients that can be interpreted as a specification of equation (3):16

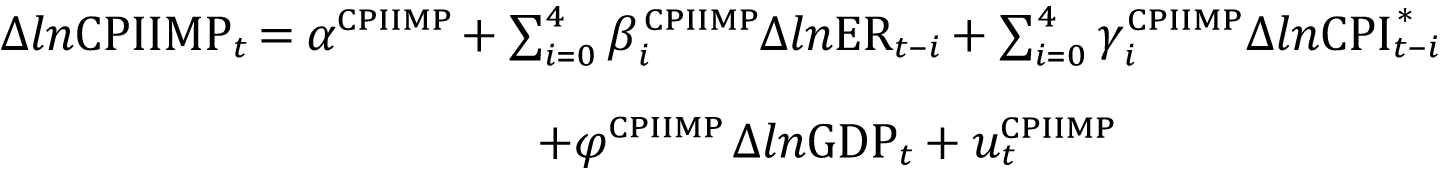

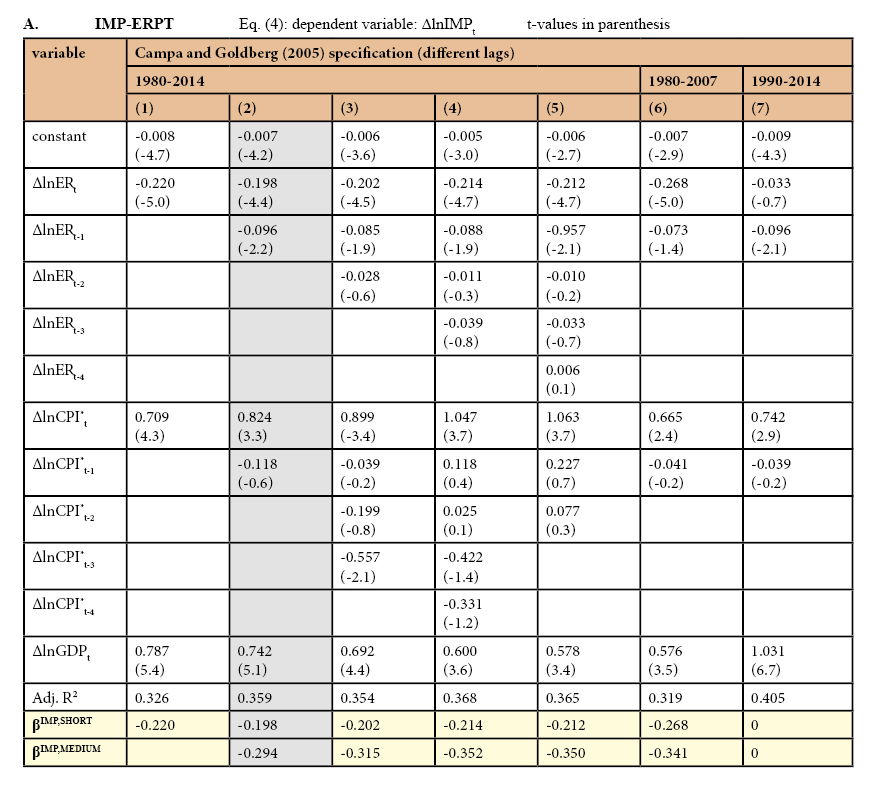

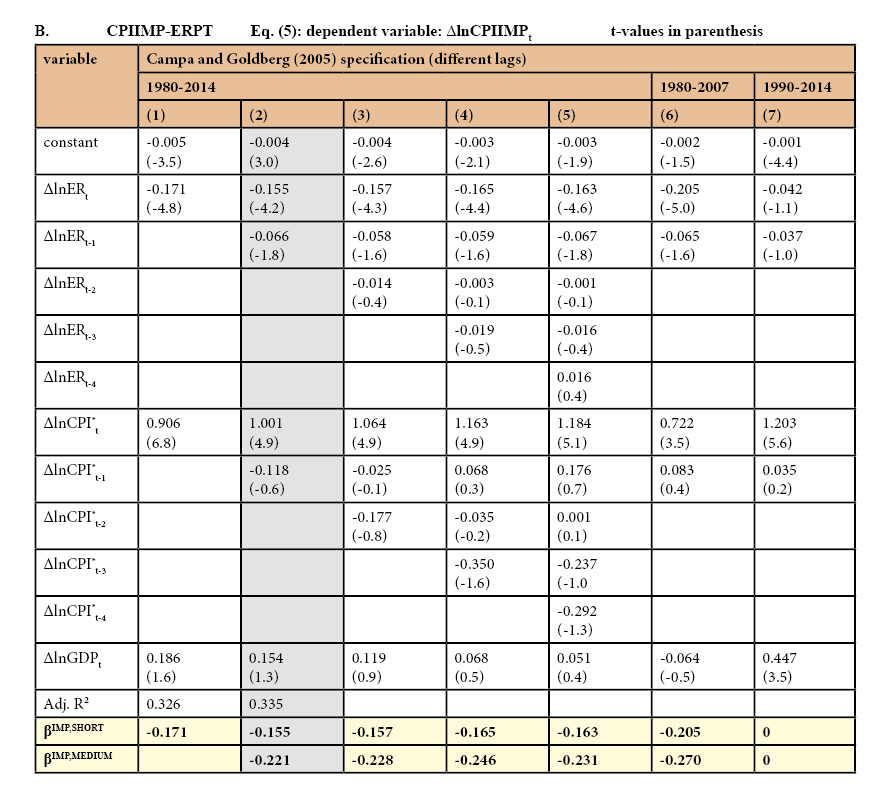

The quarterly change in import prices at time t is explained by the change in the nominal effective exchange rate ∆lnERt, manufacturing costs abroad, and the respective change of these variables in the last four quarters. The increase in foreign manufacturing costs ∆lnMCt* is operationalized by the increase of the foreign consumer price index ∆lnCPIt* (depicted by the gray line in Figure 2, Part a). The equation also includes the real gross domestic product ∆lnGDPt as a proxy for short-term demand and medium-term supply conditions in the home market.17 The short-run pass-through is given by the coefficient βIMP,SHORT= β0IMP. The medium-run IMP-ERPT elasticity βIMP,MEDIUM is given by the sum of the coefficients on the contemporaneous exchange rate and up to four lags of exchange rate terms .18 The short-run and medium-run coefficients are estimated analogously for the price of imported goods at the consumer level (CPIIMPt):

Appendix 3 presents the estimation results for Switzerland. For the sample period of 1980-2014 the short-run IMP-ERPT coefficient amounts to βIMP,SHORT=–0.20 whereas the CPIIMP-ERPT coefficient takes on an absolute value slightly lower (–0.16) (column (2) in Table A. and Table B.). Considering the medium-term – that covers an adjustment period of two quarters – the degree of ERPT rises. This is seen in particular for imported goods on the cross-border level, where βIMP,MEDIUM=–0.29; on the consumer level, imported goods and services show a βCPIIMP,MEDIUM=–0.22.19 In a second estimation, we consider the subsample period of 1980-2007 that excludes the years following the financial crisis. Over the subsample period, the short-run IMP-ERPT rises slightly to –0.27, whereas the short-run CPIIMP-ERPT increases in absolute value to –0.21. The estimated medium-run coefficients are again lower than the corresponding coefficients estimated over the full sample, with βIMP,MEDIUM=–0.34; on the consumer level βCPIIMP,MEDIUM=–0.27.20

These estimation results raise the question of whether 2007 indicates a year of significant change with respect to the responsiveness of import prices. The data described in Section 5.1 already suggest that the exchange rate pass through declined after 2007. Following Teräsvirta et al. (2010), Stock and Watson (2007), and Kirchgässner and Wolters (2006), we apply different test procedures to examine whether the hypotheses of parameter constancy can be statistically significantly rejected with respect to the ERPT coefficients. The tests are based on the estimation of equations (4) and (5), specified with one lag. Starting with the single Chow breakpoint test for a break at the date 2007Q3, the null hypothesis of no break is significantly rejected for both equations. In a second step, equations (4) and (5) are estimated with recursive least squares, using ever larger subsets of the sample data. The plot of the recursive residuals signals again some evidence of instability in the parameters of equation (5). The plot shows residuals outside the standard error bands in 2007/2008. However, the Quandt-Andrews breakpoint test – a procedure for a break at an unknown break date – chose 1990Q3 (IMP), respectively 1986Q4 (CPIIMP) as break dates. Multiple breakpoint tests again confirm these two break dates. The observation is backed by the estimation of recursive least squares. The time profile of the recursive βIMP,SHORT shows a strong variation in the early 1990s, an indication of instability. Overall, the different tests imply that the IMP-ERPT in Switzerland was considerably higher in the 1980s than in the period of 2000-2014. The re-estimation of equations (4) and (5) for the subsample 1990-2014 provides no significant short-run IMP-ERPT and CPIIMP-ERPT coefficients (Appendix 3, column (7)). In the light of these results the apparently weaker impact of the year 2007 loses relevance.

14 Chew et al. (2011) use the foreign wholesale price index.

15 Campa and Goldberg (2005) state that βIMP=-1 supports the hypothesis of producer currency pricing and βIMP=0 supports the

hypothesis of local currency pricing.

16 Campa and Goldberg (2005, p. 681) do not use the term “medium” but speak of long-run pass-through elasticities.

17 Campa and Goldberg (2005, p. 681) suggest the real GDP as control variable. The authors argue that “… one should include

as the appropriate demand variable an index of income levels across the producer’s home market and the destination market for its exports. Because we do not have information on the composition of demand facing exporters in different countries, our proxy here is the GDP of the importing country.” For the medium-term, supply conditions which can be expressed as market power or competition intensity can also play a role. Mainly due to lack of available data we assume that GDP is a proxy for these influences, too. Campa and Goldberg (2005, p. 681) conclude that “biased estimates of the pass-through coefficient could arise if foreign wages or GDP are correlated with exchange rates but omitted from the regression”. Appendix 1 describes the data used in our estimation.

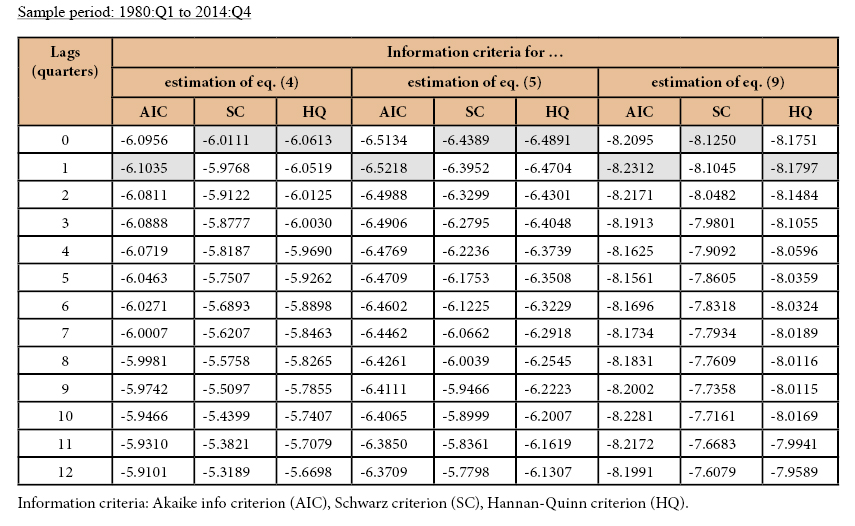

18 We formally check the lag length using different information criteria (Akaike info criterion, Schwarz criterion, Hannan-Quinn

criterion). For all three equations (4), (5), and (9) only one lag of ∆lnER and ∆lnCPI* is appropriate (Appendix 2).19 Our findings for the short-run ERPT are compatible with most empirical literature. Stulz (2007) and Herger (2012) show

short-run exchange rate pass-through elasticity onto aggregate Swiss import prices of a magnitude (–0.35 and –0.3 respectively) similar to ours. The CPIIMP-ERPT estimated by Stulz (2007) amounts to –0.27 after three months, which is slightly higher than our result. In contrast, Campa and Goldberg (2005) claim that IMP-ERPT is higher in Switzerland than in most other OECD countries. Their short-run IMP-ERPT coefficient amounts to –0.68, the third highest in a 23 OECD country sample. The sample period in Campa und Goldberg (2005) is 1975-2003. Re-estimating the equation (4) for this time period, our IMP-ERPT turns out to be quite robust with a coefficient of around –0.25. As does Stulz (2007, p. 13), we conclude that the differences in our results are mainly due to different data sets. Campa and Goldberg (2005) use different price series. Their data source for the effective exchange rate indices is International Financial Statistics and the import prices come from the OECD. In our analysis we use Swiss data from the SNB, FSO and SECO (Appendix 1). The fact that Campa and Goldberg (2005) used four lags, whereas our estimation procedure shows – based on different information criteria – an optimal lag length of only one lag, has probably a minor impact. Nevertheless, we estimate our equation (4) with up to four lags of ∆lnERt and ∆lnCPIt*. The short-run IMP-ERPT coefficient varies between –0.20 and –0.22 (Appendix 3, Table A.).

20 Cointegration tests indicate that IMP-ERPT and CPIIMP-ERPT are asymptotically complete in the sample period of 1980-

2007. However, including the post-2007 quarters in the analysis, the long-run CPIIMP-ERPT weakens.

6. Exchange Rate Pass-Through to CPI

6.1. Volatility and Stationarity of the Real Effective Exchange Rate

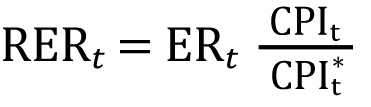

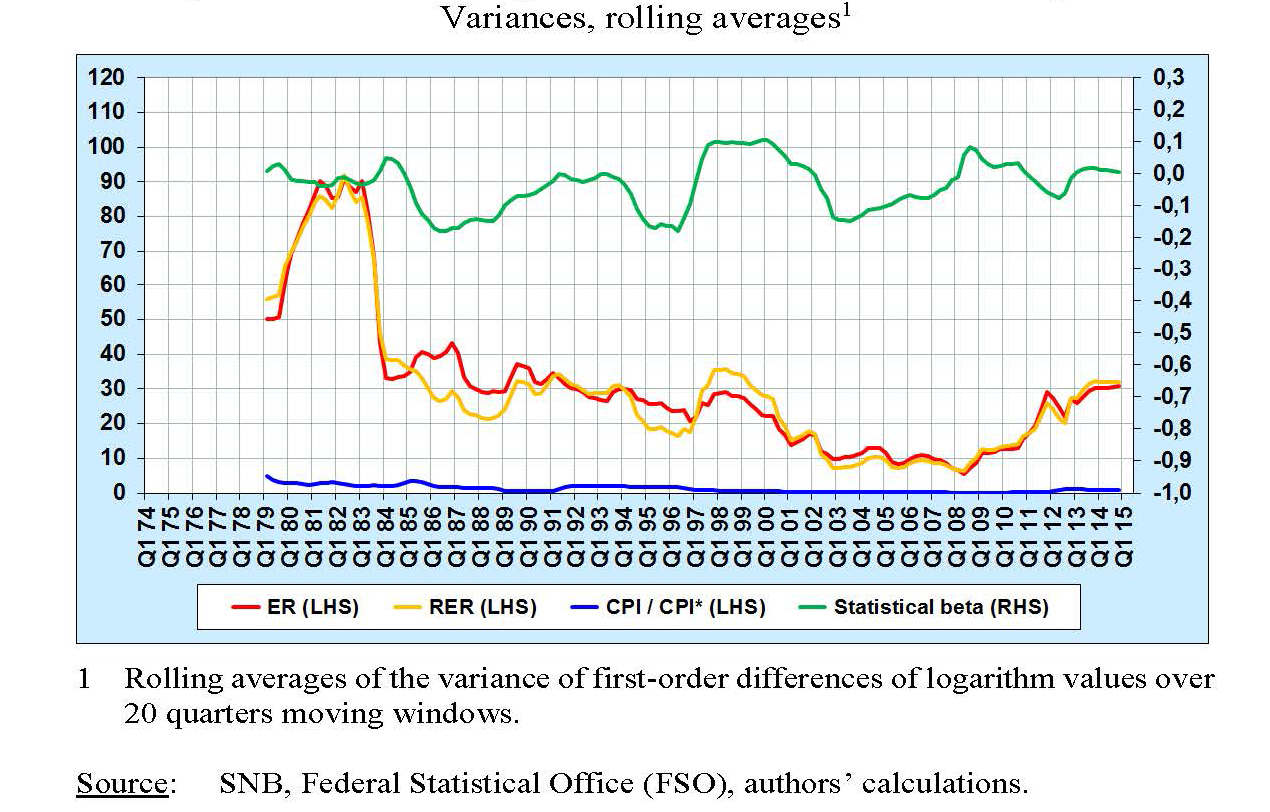

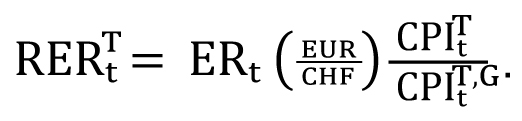

A direct comparison of the volatility of Swiss nominal and real effective exchange rates makes it possible to state the responsiveness of the relative prices of all goods and services consumed by Swiss and foreign households. The real effective exchange rate at time t

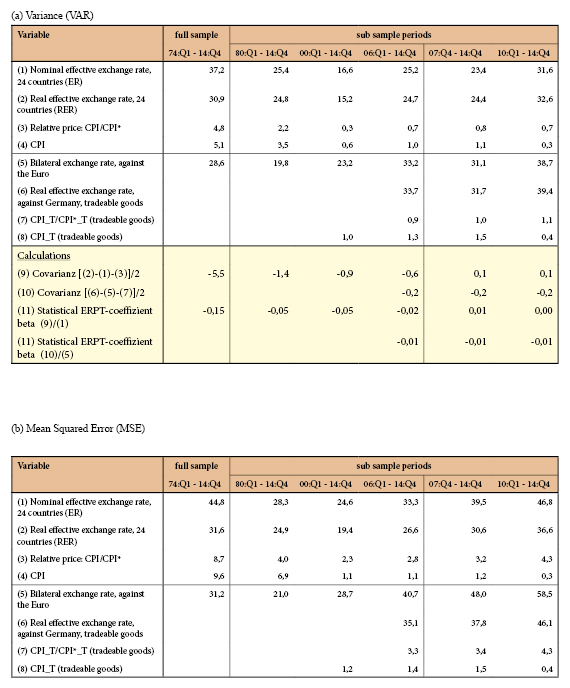

is ERt multiplied by the relative consumer price CPIt/CPIt*, whereby CPIt* denotes the foreign consumer price index. The volatilities of ERt, RERt and CPIt/CPIt* are measured in terms of the variance of first differences of their log levels. As long as purchasing power parity holds, changes in ERt are not reflected on the real exchange rate (Obstfeld, 2002). Instead, RERt is smoothed directly via the adjustment of domestic prices and should thus be markedly less volatile than ERt. However, in Swiss data, this smoothing effect with respect to the real exchange rate cannot be observed.21 Rather, the data indicate that Swiss consumer prices – like import prices – have adjusted only sluggishly to the appreciation of the Swiss franc. In the sample period of 1974-2014, the variance of ERt turns out to be 37.2, compared with 30.9 for RERt (Appendix 5).22 In addition, both variances are computed as rolling values over 20 quarters. Figure 3 shows that the corresponding variance of ERt over the sample period is only slightly higher than that of RERt, which indicates a low short-run adjustment of relative consumer prices.

Figure 3: Volatility: Effective exchange rates and relative consumer price index

6.2. The responsiveness of relative consumer prices

A simple calculation of β̃CPI coefficients allows us to measure the correlation between nominal effective exchange rates and relative consumer prices. It confirms the low responsiveness of the latter. The variance of RERt can be decomposed into the variance of ERt and the variance of the relative price CPIt/CPIt*:

The closer β̃CPI approaches a value of –1, the higher is the responsiveness of the relative consumer price index to a change of ERt. A β̃CPI close to zero points to a weak or highly delayed price adjustment that caused alignment between the volatility of the real and nominal exchange rates. In the sample period of 1974-2014, β̃̃CPI amounts to –0.15 and the rolling values of β̃CPI range between –0.18 and 0.11 (Figure 3). We get a similar result by focusing on tradable consumer goods only. Equation (8) provides the real effective exchange rate of tradable goods:

It equals the nominal effective exchange rate of the Swiss franc versus the Euro, ERt (EUR/CHF), multiplied by the relative price index for tradable goods of Switzerland CPItT and Germany CPItT,G.23 We expect the prices of tradable goods to be more sensitive to changes in ERt than the prices of non-tradable goods. However, focusing on tradable goods does not raise the ERPT coefficient. Compared to the variance of ERt, the variance of RERtT proves even higher (Appendix 5). For the subsample period of 2006 to 2014, β̃CPI,T for tradable goods turns out to be –0.01 and thus shows a slightly lower magnitude than β̃CPI (–0.02). Even though the prices of non-tradable goods should be less affected by changes in ERt, their exclusion does not raise the coefficients.

A further possible explanation for the low value of β̃CPI could be that domestic prices adjust only with a delay. This means that after a nominal exchange rate shock a considerable time lag follows until a marked pass-through occurs. Due to the stickiness of domestic prices, real exchange rates follow the movement of ERt in the short run and only gradually converge back to their original level.24 In the long run, however, adjustment should be complete, indicated by a long-run coefficient βCPI,LONG=–1. This condition holds if the time series RERt is asymptotically stationary, which can be verified through the application of a simple unit root test (Kim, 1990, Glen, 1992, Rogoff, 1996). In the sample period of 1973 to 2014, the hypothesis of a unit root in the time series of RERt can be rejected, which is also valid for the subsample period of 1973 to 2007 (Appendix 4). This supports the hypothesis that CPI-ERPT becomes complete after a period of sufficient length.

6.3. The responsiveness of CPI

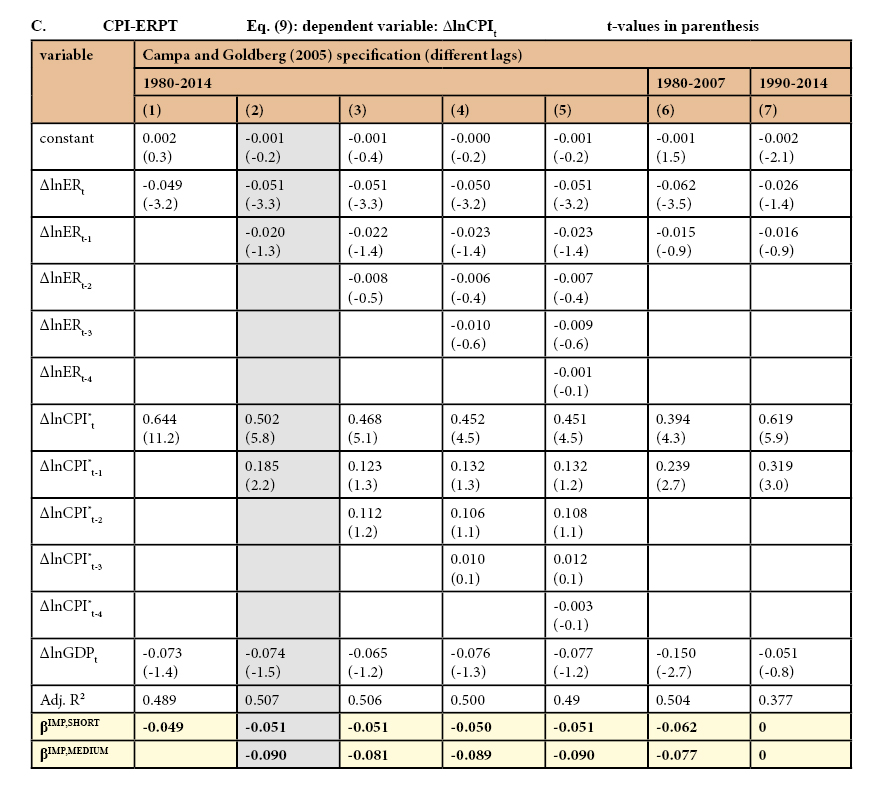

The following estimation results give further evidence that the stickiness of CPIt/CPIt* indicates a low CPI-ERPT. To estimate short-run and medium-run CPI-ERPT coefficients we once again apply the model suggested by Goldberg and Campa (2005) and Campa et al. (2005):25

![]()

The estimation results – presented in Appendix 3 – show that over the short run the Swiss CPI does not respond much to exchange rate changes. The CPI-ERPT coefficient for both sample periods is small. The coefficient βCPI,SHORT amounts to –0.05 in the period of 1980-2014 and to –0.06 in the period of 1980-2007. Considering the medium run – that again covers an adjustment period of two quarters – the degree of ERPT rises only slightly. In the full sample period, CPI-ERPT shows a coefficient βCPI,MEDIUM= –0.09, in the subsample the coefficient adjusts to –0.08. According to Stulz (2007), the short-run CPI-ERPT coefficient amounts to –0.09 after three months. His CPI-ERPT coefficient after 6 months is –0.14.26

21 Obstfeld and Rogoff (2000a) speak of a purchasing power parity puzzle.

22 If the indices follow different trends, applying the variance as a measure of volatility could lead to false conclusions. In this

case, the mean squared error MSEti=(σti)2+(μti)2 serves as a superior volatility measure (Engel, 1999). It represents the sum of the variance (σti)2 and the square of the arithmetic mean μti of the respective index. Since ERt follows a steeper trend, the volatility discrepancy between MSEtER (44.8) and MSEtRER (31.6) is boosted in the sample period. The mean squared errors computed as rolling values over 20 quarters are roughly the same for both indices.

23 See Appendix 1.

24 Since CPIt* represents the price development of 24 Swiss trading partners it is not expected to respond sensitively to changes

of the price of the Swiss franc.

25 We formally check the lag length using different information criteria. For equation (9) only one lag of ∆lnER and ∆lnCPI* is

appropriate (Appendix 2).

26 Engle and Granger (1987) tests are run for consumer prices. In both sample periods, no cointegration relationship between CPI

and ER is found. Equation (9) is further re-estimated in error-correction form. No significant cointegration relationship is found either. Both test results claim that even long-run ERPT for consumer prices is not complete. This finding is in line with earlier results from McCarthy (1999), Gagnon and Ihrig (2004), and Tressel (2011).

7. Who Benefits from the Strong Swiss Franc?

Our estimation results show that over the short and medium run, even the prices for imported goods exhibit only a minor ERPT. Exchange rate shocks are thus partially absorbed in the distribution process of imported goods and services and do not reach the Swiss consumer. Shock absorption can potentially occur in cross-border trade as well as in domestic trade, which includes the wholesale and the retail sector (Figure 4).

Figure 4: Levels of Exchange Rate Pass-Through and Shock Absorption

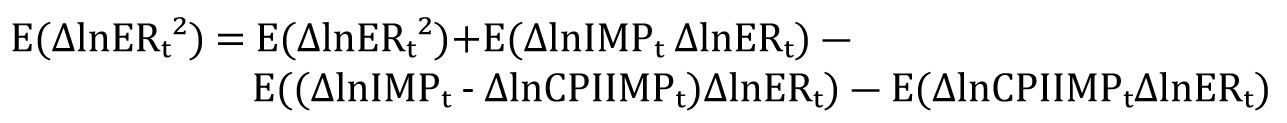

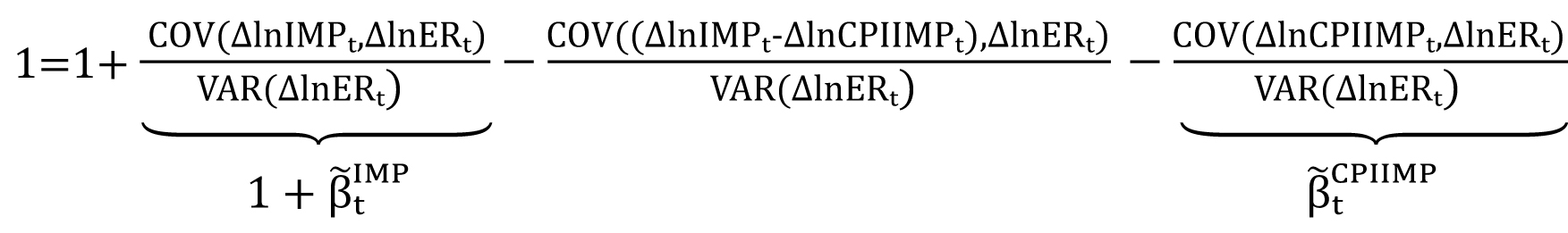

To determine where exchange rate shocks are actually absorbed along the sales chain, we use simple variance decomposition starting with the identity

From equation (10) we take logs and first differences, multiply both sides by ∆lnERt and introduce expectation values to obtain

This expression is rewritten in terms of variances (VAR) and covariances (COV):

where the coefficients β̃tIMP and β̃tCPIIMP represent

simple OLS estimators (Asdrubali et al., 1996).27 These estimators can be used to derive the percentage of exchange rate shocks absorbed on different levels and thus allow the quantification of exchange rate shock absorption in cross-border and domestic trade. Not absorbed in the distribution process and thus reflected in consumer prices is θtC=(-β̃tCPIIMP)*100.

The fraction of the shock that is absorbed in cross-border trade and not reflected in domestic import prices is given by θtCB=(1+β̃tIMP)* 100. Since IMP accounts for purchasing prices paid by importers, the coefficient θtCB measures the share of exchange rate changes absorbed by foreign producers or traders. The percentage share absorbed on domestic trade levels is given by the residual θtD=100-θtCB-θtC. How this percentage share is distributed among the domestic importers, wholesaler and retailers of imported goods cannot be determined due to a lag of according price statistics.

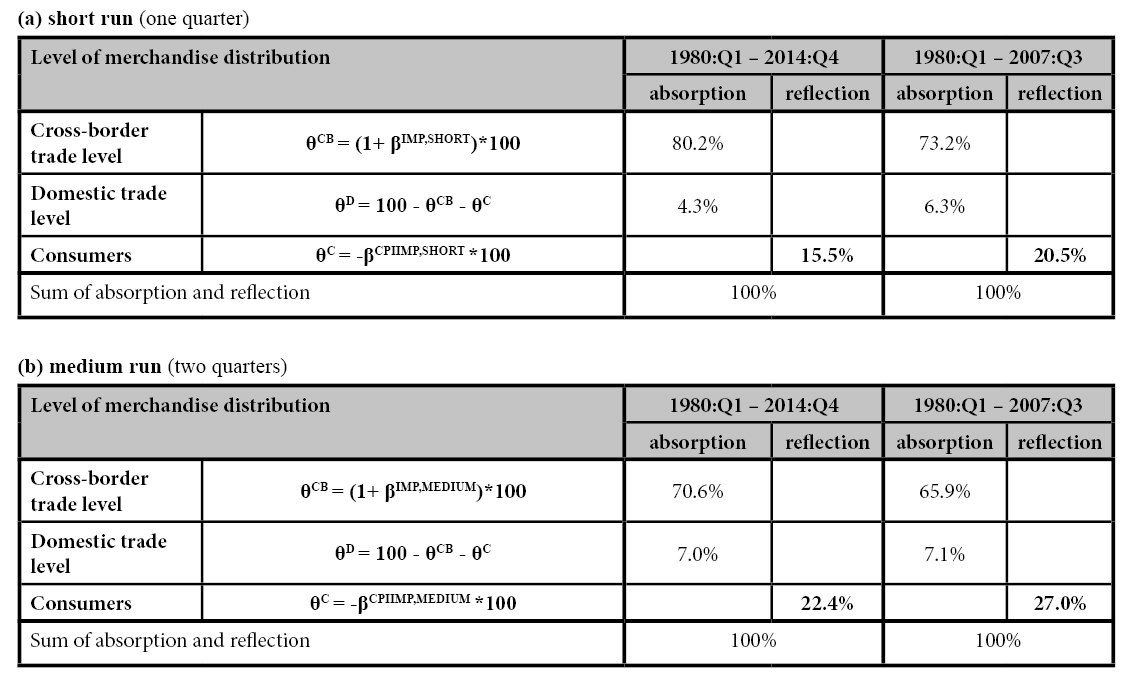

Table 1: Percentage of the exchange rate shock absorbed by different levels of merchandise distribution

The specific fractions of shock absorption depend on the responsiveness of IMP and CPIIMP. The results depicted in Table 1 are therefore derived using ERPT coefficients instead of statistical OLS estimators. Once again, the two sample periods of 1980 to 2007 and 1980 to 2014 are differentiated. For both periods, short-run and medium-run absorption is derived based on the corresponding ERPT coefficients. Before 2007, 21% of the exchange rate shocks were reflected in the domestic CPI for imported goods over the short run. This means that 79% of the exchange rate shocks did not reach the consumer level. Almost 73% were absorbed in cross-border trade and 6% by the domestic trade sector (Table 1, Part a). In the medium run, the CPIIMP-ERPT amounts to 27%. The remaining 73% of the exchange rate shock were absorbed. 66% went to foreign producers or traders and 7% were absorbed by the domestic trade level. Considering the full sample period of 1980-2014, the shock absorption in the distribution process shows generally higher. In the short (medium) run only 16% (22%) of shocks were reflected in consumer prices for imported goods. The percentage amount absorbed in domestic trade fell slightly to 4% (7%). Simultaneously, the proportion absorbed in cross-border trade rose to 80% over the short run and to nearly 71% over the medium run.

27 See Campa et al. (2005).

8. Conclusions

The effective exchange rate of the Swiss franc has soared since the outbreak of the financial crisis in 2007. As price statistics show, the appreciation led only to a minor adjustment of the Swiss terms of trade, attributed to sticky import prices as well as export prices measured in Swiss francs respectively. Focusing on the import side, the low responsiveness of the Swiss terms of trade indicates a weak ERPT with respect to Swiss import prices. To quantify pass-through effects we apply an approach proposed by Campa and Goldberg (2005), which allows us to distinguish short-run and medium-run effects. We further look at different price levels: import prices (IMP-ERPT), consumer prices for imported goods (CPIIMP-ERPT), and the overall consumer price index (CPI-ERPT). Our results can be summarized as follows:

ERPT is higher with respect to import prices than with respect to consumer prices. In the period of 1980-2007, the short-run IMP-ERPT coefficient – measuring the adjustment within a quarter – amounts to –0.27, whereas the pass-through into the prices of imported goods on the consumer level is slightly lower. The short-run CPI-ERPT coefficient is –0.06. ERPT increases when the adjustment period is extended from one quarter to 6 months. Our analyses further suggests a moderate slowdown of the pass-through after 2007, marked by declining ERPT coefficients in the prolonged sample period of 1980-2014. However, different tests of parameter stability applied signal no strong evidence for a structural break in 2007.

Our findings allow inferences of where exchange rate gains are absorbed along the sales chain between foreign producers and Swiss consumers. From 1980 to 2007, the largest share of exchange rate shocks is absorbed in cross-border trade, leaving only about 7% to domestic traders. Swiss consumers of imported goods felt around 27% of initial exchange rate shocks. In the prolonged sample period of 1980 to 2014, foreign producers and traders absorbed even more of the exchange rate shock. These findings underscore the position taken by Swiss retailers, whereby the benefits of the currency appreciation get caught at the Swiss border.

9. References

Adolfson, Malin (2001): Monetary Policy with Incomplete Exchange Rate Pass-Through. Sveriges Riksbank, Working Paper Series No. 127 (September 2001).

Amstad, Marlene; Fischer, Andreas M. (2010): “Monthly Pass-Through Ratios”. In: Journal of Economic Dynamics and Control 34 (7), pp. 1202–1213.

Asdrubali, Pierfederico; Sørensen, Bent. E.; Yosha, Oved (1996): “Channels of Interstate Risk Sharing: United States 1963–1990”. In: Quarterly Journal of Economics 111 (4), pp. 1081–1110.

Auer, Ralph A.; Schoenle, Raphael S. (2012): Market Structure and Exchange Rate Pass-Through. Federal Reserve Bank of Dallas, Globalization and Monetary Policy Institute, Working Paper No. 130 (February 2012).

Balastèr, Peter (2011): „Weitergabe von Einkaufsvorteilen aufgrund der Frankenstärke“. In: Die Volkswirtschaft (Das Magazin für Wirtschaftspolitik), Eidgenössisches Volkswirtschaftsdepartement und Staatssekretariat für Wirtschaft (Ed.) (No. 11), pp. 56–60.

Burstein, Ariel T.; Neves, João C.; Rebelo, Sergio (2003): “Distribution Costs and Real Exchange Rate Dynamics During Exchange-rate Based Stabilizations”. In: Journal of Monetary Economics 50 (6), pp. 1189–1214.

Bundesamt für Statistik (BFS)/Swiss Federal Statistical Office (2011): Produzenten- und Importpreisindex (Dezember 2010=100). Methodenübersicht. Neuchâtel (February 2011).

Campa, José M.; Goldberg, Linda S. (2005): “Exchange Rate Pass-Through into Import Prices”. In: The Review of Economics and Statistics 87 (4), pp. 679–690.

Campa, José M.; Goldberg, Linda S.; González-Mínguez, José M. (2005): Exchange-Rate Pass-Through to Import Prices in the Euro Area. The National Bureau of Economic Research (NBER) Working Paper No. 11632 (September 2005).

Chew, Joey; Tan, Siang M.; Ouliaris, Sam (2011): Exchange Rate Pass-Through Over the Business Cycle in Singapore. International Monetary Fund (IMF) Working Paper No. 11/141 (June 2011).

Corsetti, Giancarlo (2007): New Open Economy Macroeconomics. Centre for Economic Policy Research (CEPR) Discussion Paper No. 6578. London (November 2007).

Danthine, Jean-Pierre (2012): Monetary Policy is not Almighty. Speech by Jean-Pierre Danthine, Vice Chairman of the Governing Board of the Swiss National Bank, at the Journée Solutions Bancaires, Geneva, May 31, 2012.

De Brandt, Olivier; Banerjee, Anindya; Koźluk, Tomasz (2008): “Measuring Long-Run Exchange Rate Pass-Through”. In: Economics (The Open-Access, Open-Assessment E-Journal); Special Issue „Recent Developments in International Money and Finance“ 2 (2008-6).

Deutsche Bundesbank (2008): Gesamtwirtschaftliche Effekte realer Wechselkursänderungen. In: Monatsberichte der Deutschen Bundesbank (März 2008). Frankfurt am Main, Germany, pp. 35–61.

Dornbusch, Ruediger (1987): “Exchange Rates and Prices”. In: American Economic Review 77 (1), pp. 93–106.

Engel, Charles (1999): “Accounting for U.S. Real Exchange Rate Changes”. In: Journal of Political Economy 107 (3), pp. 507–537.

Engel, Charles (2002): “Expenditure Switching and Exchange Rate Policy”. The National Bureau of Economic Research (NBER) Macroeconomics Annual 2002 (Vol. 17), pp. 231–272.

Engle, Robert F.; Granger, Clive W.J. (1987): “Co-Integration and Error Correction: Representation, Estimation, and Testing”. In: Econometrica 55 (2), pp. 251–276.

EVD - Eidgenössisches Volkswirtschaftsdepartement (2011a): Teilkartellverbot mit Rechtfertigungsmöglichkeit: Anpassung von Artikel 5 Kartellgesetz gemäß Entscheid des Bundesrates vom 17. August 2011. Bern.

EVD - Eidgenössisches Volkswirtschaftsdepartement (2011b): Konferenzielle Vernehmlassung zur Revision des Kartellgesetzes. Bern (September 23rd, 2011).

FCA- Swiss Federal Customs Administration/Eidgenössische Zollverwaltung (EZV); Sektion Diffusion und Analysen (2006): Schweizerische Aussenhandelsindizes. Benutzerleitfaden. Bern (May 2006).

Fischer, Andreas M.; Lutz, Matthias; Wälti, Manuel (2010): “Pricing-To-Markets and Firm Size: Survey Evidence from Swiss Exporters”. In: Aussenwirtschaft 65 (March 1), pp. 73–88.

Froot, Kenneth P.; Klemperer, Paul D. (1989): “Exchange Rate Pass-Through when Market Share Matters”. In: The American Economic Review 79 (4), pp. 637–654.

FSO - Swiss Federal Statistical Office/Bundesamt für Statistik (BFS) (2011): Produzenten- und Importpreisindex (Dezember 2010=100). Methodenübersicht. Neuchâtel (February 2011).

Gagnon, Joseph E.; Ihrig, Jane (2004): Monetary Policy and Exchange Rate Pass Through. Board of Governors of the Federal Reserve System, International Finance Discussion Papers Number 704. Revised Version.

Glen, Jack D. (1992): “Real Exchange Rates in the Short, Medium, and Long Run”. In: Journal of International Economics 33 (1-2), pp. 147–166.

Goldberg, Pinelopi K.; Knetter, Michael M. (1997): “Goods Prices and Exchange Rates: What Have We Learned?” In: Journal of Economic Literature 35 (3), pp. 1243–1272.

Goldfajn, Ilan; R. da C. Werlang, Sergio (2000): The Pass-through from Depreciation to Inflation: A Panel Study. Department of Economics, Pontificia Universidade Catolica (PUC), Rio de Janeiro, Brazil. Working Paper No. 423.

Heath, Alexandra; Roberts, Ivan; Bulman, Tim (2004): “Inflation in Australia: Measurement and Modelling”. In: Kent, Christopher; Guttmann Simon (Ed.): The Future of Inflation Targeting – Conference 2004, Economic Group, Reserve Bank of Australia, Sidney, pp. 167-207.

Herger, Nils (2012): “Exchange Rates and Import Price in Switzerland”. In: Swiss Journal of Economics and Statistics 148 (III), pp. 381–407.

Hildebrand, Philipp (2011): Short Statement with Regard to the Introduction of a Minimum Swiss Franc Exchange Rate against the Euro. Philipp Hildebrand, Chairman of the Governing Board of the Swiss National Bank, Zurich, Switzerland, September 9, 2011.

Jordan, Thomas J. (2015): SNB Monetary Policy after the Discontinuation of the Minimum Exchange Rate. Chairman of the Governing Board of the Swiss National Bank. 107th Ordinary General Meeting of Shareholders of the Swiss National Bank, Bern, April 24, 2015.

Kellermann, Kersten; Schlag, Carsten-Henning (2011): Frankenstärke und Importpreisreagibilität: Kurz-, mittel- und langfristige Effekte. In: Konjunkturforschungsstelle Liechtenstein (KOFL) (Ed.): KOFL Working Papers. Vaduz, Liechtenstein (October 2011, No. 10).

Kim, Yoonbai (1990): “Purchasing Power Parity in the Long Run. A Cointegration Approach”. In: Journal of Money, Credit and Banking 22 (4), pp. 491–503.

Kirchgässner, Gebhard; Wolters, Jürgen (2006): Einführung in die moderne Zeitreihenanalyse. München: Verlag Franz Vahlen (WiSo-Kurzlehrbücher).

MacKinnon, James G. (1996): “Numerical Distribution Functions for Unit Root and Cointegration Tests”. In: Journal of Applied Econometrics 11 (6), pp. 601–618.

McCarthy, Jonathan (1999): Pass-Through of Exchange Rates and Import Prices to Domestic Inflation in Some Industrialized Economies. BIS Working Papers No. 79. Basel, Switzerland.

Obstfeld, Maurice (2002): Exchange Rates and Adjustment: Perspectives from the New Open-Economy Macroeconomics. Keynote Speech. Bank of Japan. In: Monetary and Economic Studies. Special Edition (December 2002), pp. 23–46.

Obstfeld, Maurice; Rogoff, Kenneth S. (2000a): “The Six Major Puzzles in International Macroeconomics: Is there a Common Cause?” In: Ben Bernanke und Kenneth S. Rogoff (Ed.): National Bureau of Economic Research (NBER) Macroeconomics Annual 2000. Cambridge, Mass., USA: MIT Press, pp. 339–390.

Obstfeld, Maurice; Rogoff, Kenneth S. (2000b): “New Directions for Stochastic Open Economy Models”. In: Journal of International Economics 50, pp. 117–153.

Rogoff, Kenneth S. (1996): “The Purchasing Power Parity Puzzle”. In: Journal of Economic Literature 34 (2), pp. 647–668.

SECO - State Secretariat for Economic Affairs [Staatssekretariat für Wirtschaft] (2011): Weitergabe von Einkaufsvorteilen aufgrund der Frankenstärke („Transparenzstudie“). Working Paper. Bern (November 2011).

SKS - Stiftung für Konsumentenschutz (2011): Starker Franken: SKS fordert einen runden Tisch, Preise von Importgütern müssen endlich deutlich sinken. Medienmitteilung vom 14. Juli 2011. Bern, Switzerland.

Starbatty, Joachim (2011): „Geldpolitik ist kein starkes Schwert in Krisenzeiten“. In: Neue Zürcher Zeitung (NZZ), August 10, 2011.

Stock, James H.; Watson, Mark W. (2007): Introduction to Econometrics. 2nd Edition. Boston: Pearson/Addison Wesley International Edition (The Addison-Wesley series in economics).

Stulz, Jonas (2007): Exchange Rate Pass-Through in Switzerland: Evidence from Vector Autoregressions. Swiss National Bank Economic Studies No. 4.

Taylor, John (2000): “Low Inflation, Pass-Through, and the Pricing Power of Firms”. In: European Economic Review 44 (7), pp. 1389–1408.

Teräsvirta, Timo; Tjøstheim, Dag; Granger, Clive W. J (2010): Modelling Nonlinear Economic Time Series. Oxford, New York: Oxford University Press (Advanced texts in econometrics).

Tressel, Thierry (2011): Impact of Exchange Rate Movements on Exports Performance and Consumer Prices. In: International Monetary Fund (IMF) (Ed.): IMF Country Report No. 11/116. Switzerland: Selected Issues Papers, Washington, D.C. (May 2011).

VSIG Handel Schweiz (2011): Die Chance der Krise. Basel, Switzerland (August 9, 2011).

WEKO - Eidgenössische Wettbewerbskommission (2011): Unvollständige Weitergabe von Wechselkursvorteilen. Bern, Switzerland (August 2, 2011).

Appendix

Appendix 1: Data

CPI = Consumer price index

Swiss consumer price index (“Landesindex der Konsumentenpreise – LIK”), December 2010=100, seasonally adjusted. Source: Federal Statistical Office (FSO), KOF Swiss Economic Institute.

CPI* = Foreign consumer price index, trade weighted

The foreign trade weighted consumer price index is calculated as CPI*=CPI(ER/RER).

CPI/CPI* = Relative consumer price index

The relative consumer price index (CPI/CPI*) is calculated as RER/ER. Source: Swiss National Bank (SNB).

CPIIMP = Consumer price index, sub-index imported goods

Swiss consumer price index, sub-index imported goods, December 2010=100, seasonally adjusted. Source: FSO, KOF Swiss Economic Institute.

ER = Nominal effective exchange rate of the Swiss franc

Nominal effective exchange rate of the Swiss franc versus 24 trading partners, not seasonally adjusted. Source: SNB, KOF Swiss Economic Institute.

GDP = Real gross domestic product

Real gross domestic product, at prices of the preceding year, chained values (“annual overlap”), reference year 2000. Source: State Secretariat for Economic Affairs (SECO).

IMP = Import price index

Import price index (goods and services) is published by the Federal Statistical Office (FSO). For more details see FSO (2011, p. 12), December 2010=100. Source: FSO, KOF Swiss Economic Institute.

Unit value index

Unit value index (goods) is published by the Swiss Federal Customs Ad-ministration (FCA). For more details see FCA (2006), Previous year=100. Source: FCA.

RER = Real effective exchange rate of the Swiss franc

The real effective exchange rate of the Swiss franc versus 24 trading partners is calculated by the Swiss National Bank (SNB). For deflating, the SNB uses the Swiss consumer price index (“Landesindex der Konsumentenpreise”, LIK) und the consumer price indices from the trading partners, Source: SNB, KOF Swiss Economic Institute.

RERT = Real effective exchange rate of the Swiss franc against Germany (tradable goods)

The nominal exchange rate of the Swiss franc versus the Euro deflated by the relative prices of Swiss and German tradable goods. The latter is not available. For calculation the sub-indices “Index ohne Wohnungsmiete”, that covers 81.1% of the LIK and the German “Gesamtindex ohne Nettokaltmieten“ are used (Schlag and Kellermann, 2011). It covers 76.3% of the German CPI, Source: FSO, Federal Statistical Office of Germany.

ToT = Terms of Trade

The Swiss terms of trade index is published by the FCA. It is calculated as the price of exports in relation to the price of imports, based on unit value indices of the FCA, Source: FCA.

Appendix 2: Analysis of the lag structure to estimate short-run and medium-run ERPT coefficients

Appendix 3: Estimation results of the short, medium and long-run IMP-ERPT, CPIIMP-ERPT and CPI-ERPT

Appendix 4: Unit Root Tests

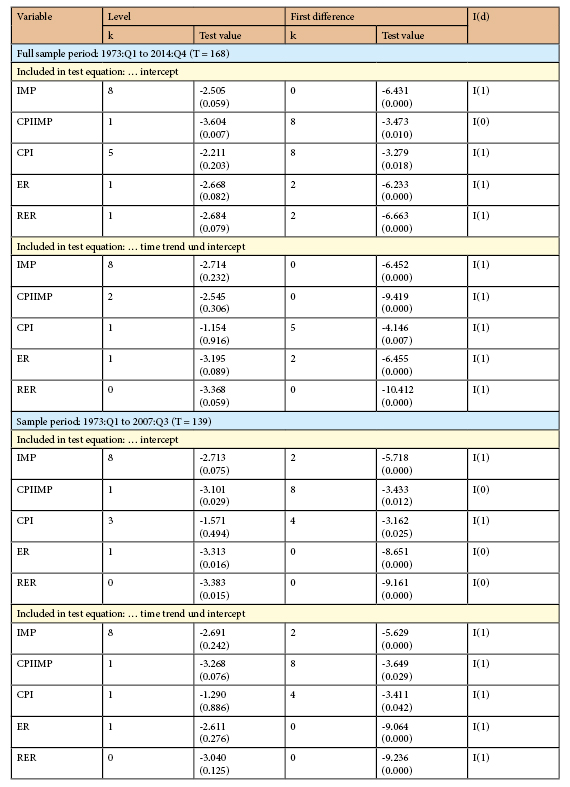

To deal with the problem of whether a time series follows a unit root we can apply an Augmented Dickey-Fuller (ADF) test. The results are presented in the following tables. Numbers in parenthesis are MacKinnon (1996) one-sided ρ-values. The null hypothesis will be rejected if the ρ-value is less than 5%. The lag length k is chosen by the Modified Akaike info criterion MAIC (Ng and Perron, 2001). EViews 8 chooses a maximum lag of kmax=13.

Appendix 5: Volatility

Volatility: Effective exchange rates and price indices

Raw data for calculations: first-order differences of logarithm values, quarterly data.

1. Engel (1999) uses the mean squared error (MSE) as volatility measure. The MSE of the change of the respective indices is the sum of the variance and square of the arithmetic mean.

2. See Appendix 1 for approximation of tradable goods.

Source: SNB, FSO, Federal Statistic Office of Germany (Destatis), author’s calculations.

Prof. Dr. Kersten Kellermann

Kersten Kellermann studied economics at the Universities of Konstanz and Western Ontario (Canada). In 1996, she received her doctorate at the University of Cologne on the subject „The interregional convergence of labour productivity”. In 2008, the venia legendi was awarded to her by the faculty of economics and social science of the University of Fribourg in Switzerland. She has been professor for economics and economic policy at Deggendorf Institute of Technology since 2015. Kersten Kellermann`s research is focused on evidence-based economic policy and regional economic growth.

Kersten Kellermann studierte Volkswirtschaftslehre an den Universitäten Konstanz und Western Ontario (Kanada). 1996 promovierte sie an der Universität Köln mit einer Arbeit zum Einfluss des Finanzausgleichs auf die Konvergenz von Regionen. 2008 erhielt sie die Venia Legendi für Volkswirtschaftslehre von der Wirtschafts- und Sozialwissenschaftlichen Fakultät der Universität Fribourg (Schweiz). Im Dezember 2014 wurde Frau Kellermann auf die Professur für Wirtschaftspolitik an die Technische Hochschule Deggendorf berufen. Sie ist Senior Research Fellow der Konjunkturforschungsstelle Vierländereck (KOVL).

Kontakt / Contact:

Dr. Carsten-Henning Schlag

Carsten-Henning Schlag studied economics at the University of Kiel, with a focus on econometrics, public finance, and macroeconomics. In 1998, he received his doctorate at the University of Cologne on the subject „Public infrastructure and economic growth in Germany”. He worked as a Senior Economist for the German Council of Economic Experts in Wiesbaden, and for the Swiss Institute of Economics (KOF) at the ETH Zurich. From 2004-2014 he was Head of the Liechtenstein Institute of Economics in Vaduz. Carsten-Henning Schlag is currently the managing director of the Konjunkturforschungsstelle Vierländereck (KOVL) and was a DAAD Visiting Professor at Deggendorf Institute of Technology during the summer semester of 2016.

Carsten-Henning Schlag studierte Volkswirtschaftslehre an der Universität Kiel, mit Schwerpunkt Ökonometrie, Finanzwissenschaft und Makroökonomik. 1998 promovierte er an der Universität Köln mit einer ökonometrischen Arbeit zur Öffentlichen Kapital-Hypothese. Danach war Herr Schlag im wissenschaftlichen Stab des Sachverständigenrates zur Begutachtung der gesamtwirtschaftlichen Entwicklung in Wiesbaden tätig und wechselte anschließend als Senior Economist an die Konjunkturforschungsstelle (KOF) der Eidgenössischen Technischen Hochschule (ETH) Zürich. Im Mai 2004 übernahm Herr Schlag die Aufgabe, eine Konjunkturforschungsstelle nach Schweizer Vorbild für das Fürstentum Liechtenstein aufzubauen und lenkte deren Geschicke in den folgenden zehn Jahren. Er ist Geschäftsführer des volkswirtschaftlichen Forschungs- und Beratungsinstituts Konjunkturforschungsstelle Vierländereck (KOVL) und hatte im Sommersemester 2016 eine DAAD-Gastprofessur an der TH Deggendorf inne.

Kontakt / Contact: